Your blog category

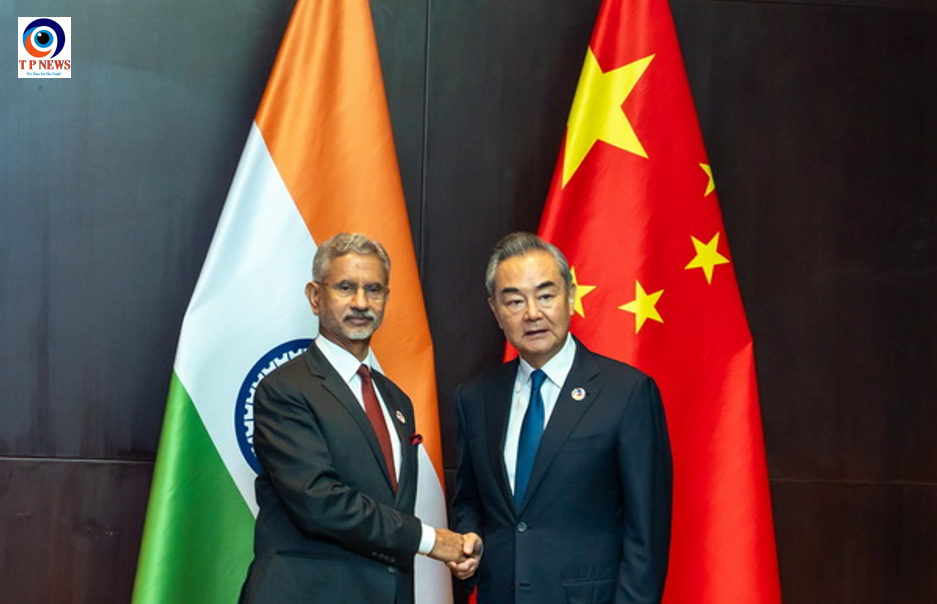

In a significant diplomatic engagement, Chinese Foreign Minister Wang Yi and Indian External Affairs Minister Dr. Subrahmanyam Jaishankar met in Vientiane on July 25, 2024. The high-level talks underscored the importance of China and India, two neighboring giants with ancient civilizations, in navigating the complex international landscape and addressing global challenges together.

Wang Yi emphasized the need for China and India to enhance dialogue, foster mutual understanding, and build trust. He highlighted that both nations, as major developing countries and emerging economies, should responsibly handle differences and focus on mutually beneficial cooperation. This, he said, would not only promote stable and sustainable bilateral relations but also serve broader global interests.

“China-India relations have a significant impact beyond the bilateral scope,” Wang Yi remarked. “Improving our relations should reflect the strategic vision of our nations as major emerging economies. We must handle our differences with political wisdom and tackle global challenges with solidarity and cooperation.”

Dr. Subrahmanyam Jaishankar echoed these sentiments, noting the shared history and interests of the two countries. He stressed that maintaining stable and predictable bilateral relations is crucial for regional peace and the promotion of a multipolar world. “India and China, with our vast populations and rich histories, have broad converging interests despite the challenges posed by the situation in the border areas. We are committed to taking a strategic and open perspective to find solutions and return our relations to a positive track,” Jaishankar said.

Both sides agreed on the importance of maintaining peace and tranquility in the border areas and pledged to make progress in consultations on border affairs. They also expressed their readiness to enhance communication within various multilateral frameworks, including the East Asia cooperation platform, SCO, G20, and BRICS, to jointly practice multilateralism and uphold the rights and interests of developing countries.

This meeting marks a significant step in fostering cooperation between China and India, two pivotal players on the global stage, as they navigate through shared challenges and work towards a more stable and prosperous future.